parker county tax assessment

TAX RATE INFORMATION. Jenny Gentry Physical Address.

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy

Tax Records include property tax assessments property appraisals and income tax records.

. Get Emergency Alerts from Parker County. Courthouse Annex 1112 Santa Fe Dr Weatherford TX 76086-5855 Mailing Address. 817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas.

817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas. Visit Our Website Today To Get The Answers You Need. The median property tax on a 14710000 house is 245657 in Parker County.

Learn how county government serves you. The Parker County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Parker County. The Parker County Assessors Office located in Weatherford Texas determines the value of all taxable property in Parker County TX.

Create an Account - Increase your productivity customize your experience and engage in information you care about. Our local school systems are financed through the collection of property taxes on the basis of Value as appraised by the Parker County Appraisal District PCAD. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Effective tax rate Parker County 00161 of Asessed Home Value Texas 00180 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Parker County 3452 Texas 3099 National 2471 Median home value Parker County 214200 Texas 172500 National 217500 Median income Parker County 77503 Texas 61874. Sales Tax and Licensing. The office of the county treasurer was established in the Texas constitution in 1846.

817 598-6133 Email Address. Parker County Assessors Office Services. A sample of the Notice of Assessment of Land and Structures - Form 11 and a letter to Parke County Taxpayers regarding the Form 11 may be viewed by selecting Notices on the menu bar then selecting Assessor.

For more information for businesses regarding about sales tax and licensing requirements in Parker visit our Sales Tax Division page. Parker County Appraisal District. Parker County Tax Office Services Offered County tax assessor-collector offices provide most vehicle title and registration services including.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office. Visit Our Official Website Today. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

1108 Santa Fe Dr Weatherford Texas 76086. Parker Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Parker Colorado. Box 2740 Weatherford TX 76086-8740 Telephone.

The Parker County Tax Collector is responsible for. Parker County Property Tax Appraisal Oconnor is the leading company representative for the Parker County Appraisal District property owners because. View details on the following taxes.

Get Emergency Alerts from Parker County. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers Change of Address on Motor Vehicle Records. The same is true of our county roads community colleges regional hospital districts EMS districts volunteer fire departments in the form of subsidies and many other services too.

See what Parker County has to offer. The Parker County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Parker County and may. She can be reached at 765 569-3490.

The median property tax on a 14710000 house is 266251 in Texas. The Parke County Assessor is Katie Potter. For over 20 years OConnor has provided property tax consulting services in the Parker County Appraisal District and has continuously produced results.

Search Local Records For Any City. Get driving directions to this office. Ad Enter Any Address and Find The Information You Need.

The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100. Parker County collects on average 167 of a propertys assessed fair market value as property tax. Property Taxes Tickets etc.

Banker for Parker County government working with departments and public for receiving and disbursing funds including general payments of county expenses payments for jury duty election workers and payroll. Or call 817458-9848 to receive alerts. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Financial Risk Assessment Template New Financial Risk Assessment Template Illwfo Schedule Template Guided Reading Lesson Plans Internal Audit

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website

Fifteen Years In Nova Scotia Might Just Fix Tax Assessment Inequities

A Guide To Your Property Tax Bill Alachua County Tax Collector

Real Estate Assessed Value Vs Fair Market Value

Travis County Texas Property Search And Interactive Gis Map

The Property Management Module Lets You Centrally Store Track And Maintain Information And Documentation F Property Management Management Facility Management

Property Tax Calculation Boulder County

Open Cama Solutions How Integration Transforms Property Tax Assessment Farragut

Tax Assessor Chester Township Nj

Why Are Texas Property Taxes So High Home Tax Solutions

Get Best Tax Return Services At Affordable Prices Weaccountax Is A Leading Accountancy Firm For Financial Services In Income Tax Return Tax Return Income Tax

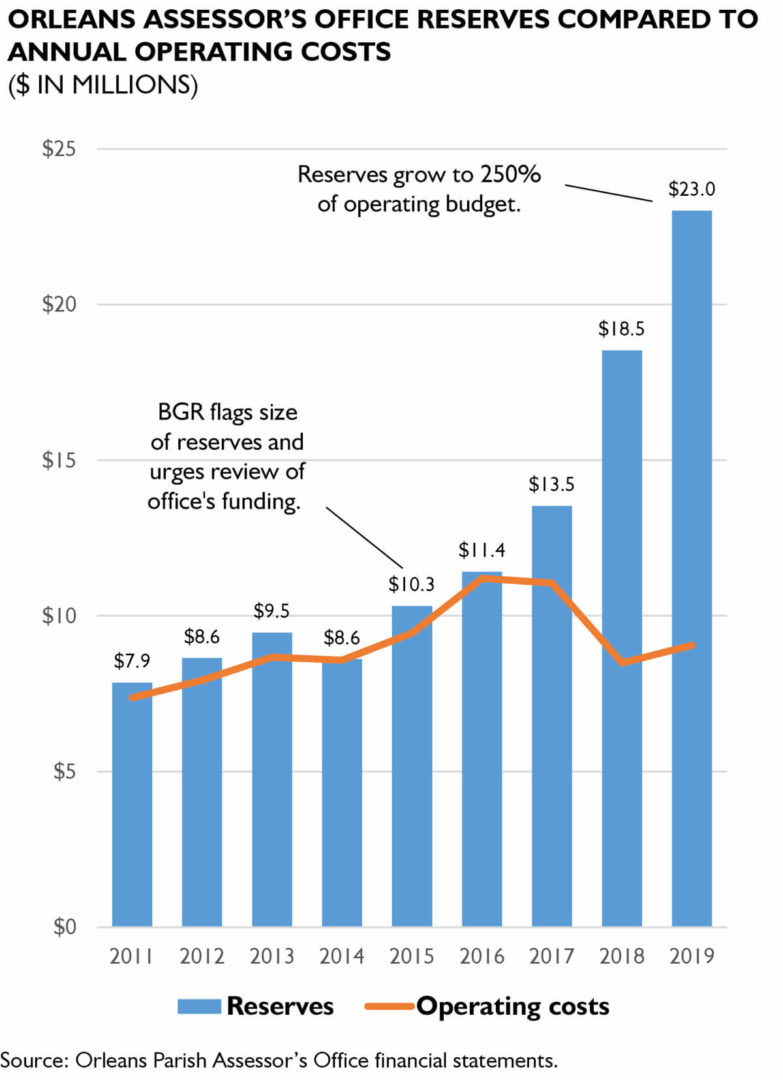

Policywatch Revisiting Assessment Issues In New Orleans

Fifteen Years In Nova Scotia Might Just Fix Tax Assessment Inequities