capital gains tax increase retroactive

Perhaps had Congress looked to enact such changes earlier in. While some Democrats have expressed concern about a capital gains increas See more.

New Tax Initiatives Could Be Unveiled Commerce Trust Company

The 1987 capital gains tax collections were slightly below 1985.

. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the. State scraps retroactive capital gains tax. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

As proposed the rate hike is already in effect. A Retroactive Capital Gains Tax Increase. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state.

This resulted in a 60 increase in the capital gains tax collected in 1986. This resulted in a 60 increase in the capital. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a.

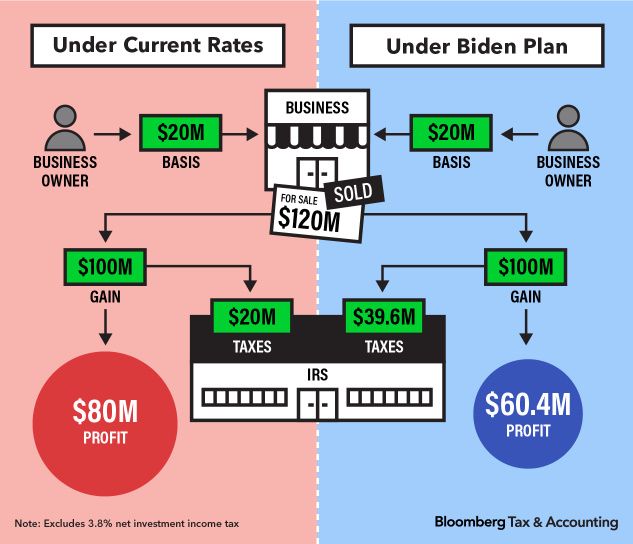

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. Not only would President Bidens plan increase the capital gains tax rate from 20 to 37 or 396 if the proposal to increase the top individual income tax rate is also. President Biden really is a class warrior.

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. Those sales of course would result in a windfall of capital-gains tax revenue for the federal government at ironically only to the naive the pre-increase rates. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. Gains in addition to the rate. The later in the year that a.

Top earners may pay up. Then there is timing. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales.

This resulted in a 60 increase in the capital gains tax collected in 1986. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. BOSTON Residents who were bracing for a retroactive tax bill on an average of 4200 can now look for a new notice in the mail with.

If the capital-gains rate is increased. The maximum rate on long-term capital. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase.

Bidens budget calls for the increase in the top capital gains rate to be implemented retroactively. The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase. Conversely proposals such as indexing capital gains to inflation could effectively reduce the rate of tax by applying the same rate to a lower tax base.

The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike.

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Tax Hikes Could Impact Uhnw Philanthropy Bernstein

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

What Is The Cryptocurrency Tax Rate Ftx Insights

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Crystal Ball Gazing To The Past Article By Pearson Co

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

Managing Tax Rate Uncertainty Russell Investments

Will Tax Changes Sink The Market Creative Planning

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

What If Biden S Capital Gains Tax Is Retroactive Morningstar